CASE STUDY

89 Roberts Road

Our latest Project in the heart of High Wycombe

Key Metrics

6 En-suite Rooms

Full Managed HMO

£200,000

Initial Investment

£97,500

Cash Recycled

20%

Annual Rental Return

The UK Property Market

Robust Track Record

The UK property market has consistently delivered strong returns over the past 50 years, with house prices rising by an average of around 7% annually.

Increasing Rental Demand

Rental demand in London and surrounding areas is incredibly strong, fuelled by a thriving job market and a growing population. With consistent demand from young professionals and students, rental prices continue to rise.

Strong Financial Standing

With a stable economy, transparent legal system, and well-regulated financial markets, the UK offers a secure environment for investment. London’s status as a global financial hub also attracts international capital, further boosting property values and investment opportunities across the UK.

High Wycombe

Transport Links

High Wycombe is a University town in London's Home Counties sitting at the end of the M4 Corridor and close to the convergence of the A404, A40/M40 and M25.

Its excellent road connections, bus depot and overground train links into Marleybone or out to Oxford make this a top town for commuters to settle when compared to the cost of living in Greater or Prime Central London.

Potential Tenants

High Wycombe benefits from an abundance of local key workers employed by the Council HQ, Police HQ, Fire Station, Hospital, University and an excess of highly acclaimed and independent grammar schools.

Employment

Promising signs of regeneration and possible gentrification seem to be under way with brands such as Porsche, Bentley and John Lewis opening large Commercial Premises.

A total of £55m investment has been specifically allocated to High Wycombe and surrounding areas.

The Property

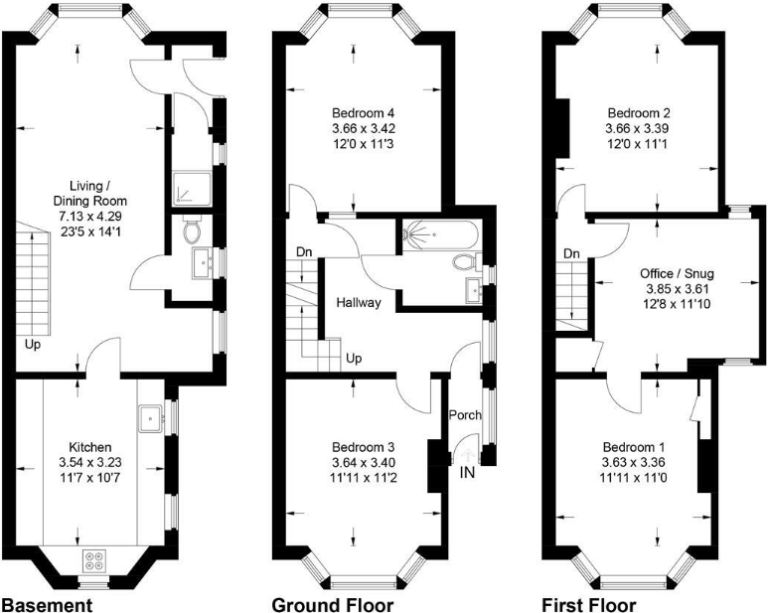

Existing Property

4 Beds, 1 Baths, 149 m²

The layout consisted of two bedrooms and a study room on the top floor; Two bedrooms and a bathroom on the middle floor; and a kitchen and a living room on the lower ground floor.

The Strategy

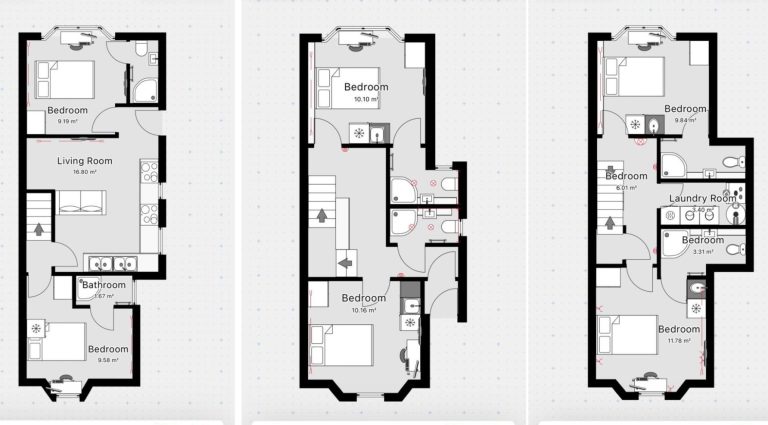

Set over 3 floors, with a semi-basement and a considerable floor area, this is the ideal property for a large HMO.

The Strategy on this project was to increase the semi-basement height by raising the ceilings, and add space on that floor by introducing a steel structure.

We carried out a complete strip out back to brick and re-configured the layouts to suit the ideal all-ensuite model.

With a construction period estimated to last between 4 to 5 months, we managed to achieve a 6-bed all-ensuite layout with a communal kitchen/living area, a dedicated laundry room, and a big outdoor garden space.

The Timeline

Offer Accepted

Dec 2023

Exchange of Contracts

Apr 2024

Refurbishment Works

May-Sep 2024

Refinance & Rent

Oct 2024

The Numbers

Acquisition

Listed Price: £450,000

Purchase Price: £400,000

Legal & Financing Fees: £12,000

Stamp Duty: £9,500

Renovation Costs: £110,000

Finance Interest Costs: £15,000

Gross Development Cost: £546,500

_________________________________________

Financed Funds: £348,000

Cash Requirement: £198,500

Refinance

Gross Development Value: £585,000

Recycled Cash: £97,500

Equity still invested: £101,000

Rental Return (per annum)

Expected Income: £59,400

Mortgage Interest Costs: (£27,400)

Running Costs: (£7,000)

Net Yield (Optimistic): 24.7% £25,000

Voids & Maintenance: (£5,000)

Net Yield (Conservative): 19.8% £20,000

Further Potential

The Works

This property has the potential to be extended further both into the Loft and into the garden.

With a loft height of over 2.2m, it will be possible to carry out a Loft Conversion introducing a dormer.

The space created will be around 50m², which would enable the creation of a further 2no big size double en-suite bedrooms.

This will require planning permission to change Class from C4 to C4 Sui-Generis.

The numbers

Loft Conversion works: £70,000

Refinance

New Gross Dev. Value (GDV): £880,000

Further Recycled Cash: £225,500

Equity still invested: £0

New Net Yield (Conservative): £22,900

About Us

Dave

Dave “Property” Kidd is the Founder and Managing Director at Property Reminted.

Having built a multi-million pound property portfolio and finding financial freedom for himself, Dave left behind his successful corporate career to pursue fulfilment in helping others achieve the same.

Sergio

Sergio Grande is our Investment Director at Property Reminted.

A RICS Chartered Surveyor and Property Investor, Sergio has a wealth of Construction experience having managed multi-million pound Commercial and Residential Schemes. This experience is used to carry out detailed analysis and to implement budget management strategies on all our Property Deals; an absolute must for optimising Return On Investment.

Copyright © 2024 Property Re:minted. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.